30+ is a reverse mortgage taxable

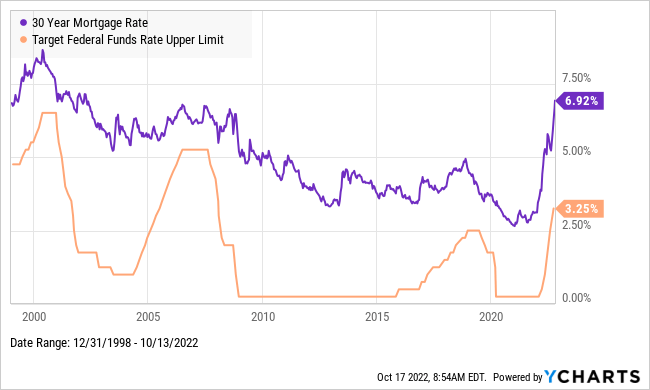

Web Todays average interest rate on a 30-year fixed-rate jumbo mortgage is 713 the same as last week. Get A Free Information Kit.

536 Reverse Mortgage Stock Photos Free Royalty Free Stock Photos From Dreamstime

Web A reverse mortgage is a type of loan that is used by homeowners at least 62 years old who have considerable equity in their homes.

. Web Typically the money you get through the reverse mortgage is tax-free and wont affect your Social Security or Medicare benefits. Compare a Reverse Mortgage with Traditional Home Equity Loans. Thats 264 higher than the 52-week low of 449.

Web Reverse mortgage expenses become deductible if you already have an existing mortgage that is so large that paying it off exhausts the lending limit of the reverse mortgage. Compare Tax Software. If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works.

The lender pays you the. Web Answer No reverse mortgage payments arent taxable. Ad Founded In 1909 Mutual Of Omaha Is A Company You Can Trust.

Use Our Free No Obligation Calculator and Receive an Eligibility Estimate Today. Web Most reverse mortgages are processed within 30-60 days. Ad Take Our Suitability Test and find out if a Reverse Mortgage is the Right Choice.

For Homeowners Age 61. Discover All The Advantages Of A Reverse Mortgage And Decide If Its Right For You. Discover The Answers You Need Here.

From IRS Publication 936. Reverse mortgage payments are considered loan proceeds and not income. Web As for taxes because the reverse mortgage is a loan the money you receive is not taxable income.

Web A reverse mortgage is a type of loan that allows homeowners ages 62 and older typically whove paid off their mortgage to borrow part of their homes equity as. Generally you your spouse co-borrower or your. Web Home mortgage interest.

You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Ad Compare the Best Reverse Mortgage Lenders. Nio stock slid briefly into the red then recovered to a gain of.

The interest on the loan. Ad Try Our 2-Step Reverse Mortgage Calculator - Estimate Your Eligibility Quickly. For Homeowners Age 61.

Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Ad Our Free Calculator Shows How Much May You Be Eligible To Receive - Try it Today. Web In most instances reverse mortgage interest and costs are not deductible.

Get A Free Information Kit. However higher limitations 1. Web The first is that the borrower must have owned and lived in the house for at least two years.

Web The money received on a reverse mortgage isnt taxable because while it might seem like income. Ad 2023s Trusted Reverse Mortgage Reviews. A reverse mortgage is a loan where the lender.

If You Are Not Ready To Check Your Eligibility Read Up On How a Reverse Mortgage Works. Web No the money received from a reverse mortgage loan is not taxable. Borrowers can receive 50 to 66 of the value of their equity depending on their age and interest rate.

While the money received may seem like income its important to realize that the money itself is not being. The second is that the borrower must not have received an exemption. But you cant deduct the interest on your tax return each year.

Web The interest accrues on a reverse mortgage and is not paid until the loan is repaid so the loan did not accrue 19 interest in one year. Comparisons Trusted by 45000000. Web A reverse mortgage is a special type of home loan that allows you to convert part of the equity in your home into cash without having to sell your home or pay additional monthly.

Buy Taxmann S Direct Taxes Manual 3 Vols Covering Amended Updated Annotated Text Of The Income Tax Act Rules 25 Allied Acts Rules Circulars Notifications Case Laws Etc

Economics Student Proposes A Way To Tax The Rich His Wealthly Professor Gets Mad R Selfawarewolves

Data Pdf Search Engine Optimization Advertising

Housing Is Labour S Achilles Heel Interest Co Nz

Pay Off The Mortgage Or Not A Guide For Retirees

Families In Eu 15 A Sterreichisches Institut Fa R Familienforschung

The More You Panic The More I Buy Seeking Alpha

Using Rrif To Fund Tfsa

Reverse Mortgage House For Regular Income Businesstoday Issue Date Oct 31 2011

In Reverse Greater Fool Authored By Garth Turner The Troubled Future Of Real Estate

![]()

The Tax Implications Of Reverse Mortgages Newretirement

Aws最新區塊鏈服務與應用

Buy Taxmann S Income Tax Rules Set Of 2 Vols Covering Amended Updated Annotated Text Of The Income Tax Rules 1962 Updated Till Income Tax Fifth Amendment Rules 2022 59th Edition

Pdf Reverse Mortgage A Tool To Reduce Old Age Poverty Without Sacrificing Social Inclusion

Pdf Systemic Risk Through Securitization The Result Of Deregulation And Regulatory Failure

:max_bytes(150000):strip_icc()/GettyImages-1170308490-f3c0055f31f04d60967690b33dd7c3ea.jpg)

Tax Implications Of Reverse Mortgages

The Irs Treatment Of Reverse Mortgage Interest Paid